Estate Planning Attorney - An Overview

The 7-Second Trick For Estate Planning Attorney

Table of ContentsEverything about Estate Planning AttorneySome Ideas on Estate Planning Attorney You Need To KnowAbout Estate Planning AttorneyA Biased View of Estate Planning Attorney5 Easy Facts About Estate Planning Attorney ShownEstate Planning Attorney Things To Know Before You BuyThe smart Trick of Estate Planning Attorney That Nobody is Discussing

A skilled lawyer can give valuable assistance when handling properties throughout one's life time, moving residential property upon fatality, and decreasing tax liabilities. By asking such questions, an individual can acquire insight into a lawyer's credentials and identify if they are a good fit for their specific circumstance. With this info, people will better understand how their estate plan will be handled in time and what steps need to be taken if their scenarios transform.It is advised that people each year examine their strategy with their attorney to make sure that all papers are precise and updated. During this review procedure, inquiries concerning property administration and taxes can additionally be resolved. By dealing with a seasoned lawyer who recognizes the demands of their customers and stays current on changes in the regulation, people can really feel positive that their estate plan will certainly show their wishes and goals for their beneficiaries if something were to take place to them.

A great estate planning lawyer need to recognize the regulation and have a strong history in offering sound guidance to help customers make notified decisions regarding their estates. When interviewing possible estate attorneys, it is very important to request references from customers they have formerly dealt with. This can give valuable understanding into their capacity to develop and implement an efficient strategy for each customer's unique circumstances.

What Does Estate Planning Attorney Do?

This may include composing wills, counts on, and various other documents related to estate preparation, offering guidance on tax obligation matters, or collaborating with various other advisors such as economic organizers and accountants - Estate Planning Attorney. It is additionally an excellent idea to figure out if the lawyer has experience with state-specific regulations or regulations connected to properties so that all required steps are taken when creating an estate plan

When producing an estate plan, the length of time can vary considerably relying on the intricacy of the person's circumstance and requirements. To make sure that an effective and thorough plan is created, people ought to put in the time to locate the right lawyer that is seasoned and knowledgeable in estate preparation.

The documents and instructions produced during the preparation procedure come to be legitimately binding upon the customer's fatality. A qualified financial advisor, according to the desires of the departed, will then begin to distribute count on possessions according to the client's directions. It is essential to keep in mind that for an estate strategy to be reliable, it has to be correctly implemented after the customer's fatality.

Getting The Estate Planning Attorney To Work

The assigned executor or trustee must ensure that all properties are dealt with according to legal needs and in accordance with the deceased's wishes. This typically entails gathering all documentation pertaining to accounts, financial investments, tax documents, and other items defined by the estate plan. In addition, the administrator or trustee may require to coordinate with financial institutions and beneficiaries associated with the circulation investigate this site of assets and other matters referring to settling the estate.

People require to plainly recognize all elements of their estate plan prior to it is set in motion. Collaborating with a right here seasoned estate planning attorney can assist guarantee the documents are effectively prepared, and all expectations are fulfilled. On top of that, an attorney can supply insight right into exactly how numerous lawful tools can be used to protect properties and optimize the transfer of wealth from one generation to an additional.

Indicators on Estate Planning Attorney You Need To Know

Inquire concerning their experience in managing complicated estates, consisting of trusts, wills, and other records associated with estate planning. Figure out what type of education and learning and training they have actually received in the field and ask if they have any type of customized expertise or certifications in this location. Make inquiries concerning any kind of costs associated with their services and ascertain whether these expenses are dealt with or based on the work's intricacy (Estate Planning Attorney).

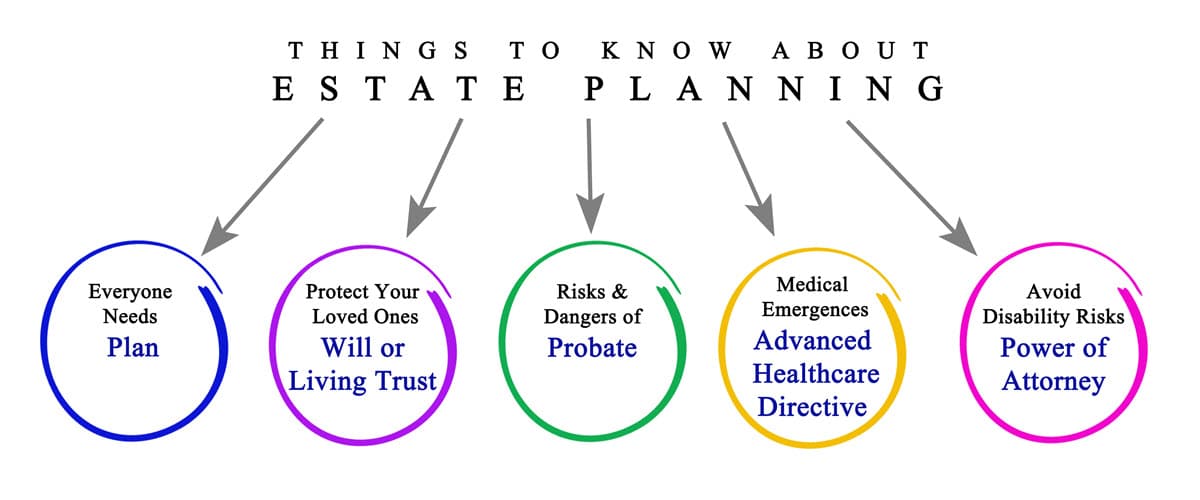

Estate intending describes the prep work of jobs that take care of a person's economic scenario in the event of their incapacitation or fatality. This preparation consists of the legacy of properties to successors and the negotiation of estate tax obligations and financial debts, in addition to various other factors to consider like the guardianship of minor kids and animals.

Some of the steps consist of detailing properties and financial debts, examining accounts, and composing a will. Estate planning tasks consist of making a will, establishing up depends on, making charitable donations to restrict estate tax obligations, naming an executor and recipients, and establishing funeral plans. A will offers directions regarding property and guardianship of minor youngsters.

Not known Facts About Estate Planning Attorney

Estate planning can and ought to be utilized by everyonenot simply the ultra-wealthy., managed, and distributed after death., pension plans, financial debt, and more.

Anybody canand shouldconsider estate preparation. There are numerous factors why you might begin estate planning, such as protecting family members wealth, attending to a making it through partner and youngsters, moneying youngsters's or grandchildren's education, and leaving your legacy for a charitable cause. Writing a will is among the most essential steps.

Bear in mind, any type of accounts with a recipient pass directly to them. Make sure your recipient details is up-to-date and all of your various other info is precise. Establish up joint accounts or transfer of fatality designations.

6 Easy Facts About Estate Planning Attorney Described

This implies the account relocates directly from the deceased to the surviving proprietor. A transfer of death designation enables you to call a person that can take control of the account after you pass away without probate. 7. Pick your estate manager. This person is accountable for dealing with your financial matters after you die.

Create your will. Wills don't just unravel any kind of financial unpredictability, they can additionally lay out plans for your minor youngsters and family pets, and you can likewise instruct your estate to make philanthropic contributions with the funds you leave behind. Make sure you look over everything every pair of years and make modifications whenever you see fit.

Send out a copy of your will certainly to your administrator. Send out one to the person that will think obligation for your events after you die and maintain one more duplicate somewhere over here secure.

Getting My Estate Planning Attorney To Work

There are tax-advantaged financial investment vehicles you can make the most of to aid you and others, such as 529 college savings prepares for your grandchildren. A will certainly is a legal file that supplies instructions about exactly how a person's residential or commercial property and custody of minor kids (if any type of) need to be handled after death.

The will likewise suggests whether a trust fund should be created after death. Depending upon the estate owner's intents, a trust fund can go right into result throughout their lifetime through a living trust or with a testamentary count on after their death. The authenticity of a will is identified with a legal process referred to as probate.